Wealth Advisory & Management is the core service which Hudson Oak was founded on. A wealth advisory relationship is all encompassing and is designed to provide clients with their own personal advisor. This relationship combines the various stand-alone services we may otherwise offer such as:

FINANCIAL PLANNING

INVESTMENT MANAGEMENT

A Wealth Advisory & Management relationship ties together the various services we offer in order to most favorably and efficiently serve a client. By engaging us as your dedicated advisor in a Wealth Advisory & Management capacity, clients are able to bundle services together at the lowest cost per service than generally if they engaged each service separately. We believe that through working with clients in this manner, we best align incentives and clients receive the most value in working with Hudson Oak.

Fee structure

Under a Wealth Advisory & Management Relationship, a client’s fees are comprised of some combination of a monthly financial planning fee and/or a quarterly investment fee charged in arrears. The combination of which fee is paid and how much depends on the client’s profile and relationship with Hudson Oak. Consider three potential fee scenarios below:

Client #1 engages Hudson Oak through a Wealth Advisory & Management Relationship. They are a high earner, but have not yet begun meaningfully building an investment portfolio. This client will likely pay a full monthly financial planning fee upwards of $500 to $700 per month.

Client #2 engages Hudson Oak through a Wealth Advisory & Management Relationship. They have a $350,000 investment portfolio that Hudson Oak will assist in managing in conjunction with comprehensive financial planning work. This client will pay a quarterly investment fee based on the $350,000 portfolio and a reduced monthly financial planning fee likely in the range of $250 to $400 per month.

Client #3 engages Hudson Oak through a Wealth Advisory & Management Relationship. They have a $1 Million investment portfolio that Hudson Oak will assist in managing in conjunction with comprehensive financial planning work. This client will pay a quarterly investment fee based on the $1 Million portfolio and will pay no monthly financial planning fee. At this level a client is still receiving both services of financial planning and investment management, but under the single quarterly investment fee.

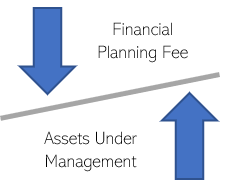

Think of the fee structure of a Wealth Advisory & Management Relationship as a sliding scale. For clients with smaller levels of investable wealth, a higher financial planning fee may be assessed. However, as over time more investable wealth is managed by Hudson Oak the financial planning fee is reduced and replaced by a quarterly investment fee. Eventually, the monthly planning fee may be suspended entirely once high levels of investments are reached. This is all laid out clearly in a proposal of a detailed fee structure to clients before entering into a relationship.

The scenarios above are merely examples. Each client’s fee structure and terms will be specific to their agreement with Hudson Oak and may differ from the example scenarios above.