What is a Charitable Remainder Trust (CRT)?

A Charitable Remainder Trust (CRT) is a unique type of charitable split-interest trust that may allow a taxpayer to defer income tax, receive a charitable deduction, and benefit a charity - all while retaining an income stream for a set term (or life). Taxpayers that have highly appreciated assets looking for an exit strategy that can be both income and estate tax efficient may want to consider this trust.

A CRT is established when a donor transfers property (ideally, highly appreciated yet marketable assets) to an irrevocable trust, but retains an income interest for himself/herself (or some other non-charitable beneficiary). The donor receives the income interest, typically at least annually, for a term of years or until death. At the end of that term, the remaining property in the trust passes to a charity that the donor has specified.

There are Two Primary Types of CRTs

CRUT - A Charitable Remainder Unitrust (CRUT) is a trust that pays it’s present income interest based on a set percentage of the trust’s assets. This set percentage is typically established at the beginning of the trust, but as the trust value changes so will the actual amount paid out as income each year.

CRAT - A Charitable Remainder Annuity Trust (CRAT) is a trust that pays it’s present income interest based on a set annuity amount. This annuity amount is typically established as well as the beginning of the trust. In this instance, the distribution amount paid out remains constant during the years of the trust.

The resulting difference is that a CRUT pays a varying annuity, whereas a CRAT’s payment is set. In other words, the amount paid is likely to change each year when you have a CRUT since the payment is based on a percentage of the assets in the trust and the income amount is based on annual fluctuations in the value of the trust's property. As it goes up, so does the annuity paid each year. If it drops in value, so will the annuity. As a result, most donors that establish a CRT prefer it to be a CRUT since they can better share in the upside of the trust assets, particularly if the trust will have a long time to appreciate.

While there is a place for both CRUTs and CRATs in effective wealth planning, the CRUT variation is what we’ll focus on specifically for the rest of this article.

When and Why is a CRUT appealing?

A CRUT is most appealing to families of highly appreciated wealth that want to defer their tax burden associated with looking to exit the highly appreciated asset. In addition, it is imperative that the donor also has a level of charitable intent as the whole point of the trust is to leave the remainder interest to a qualifying charity at the end.

A CRUT is appealing though because the donor will receive a present income tax charitable deduction (or an estate tax charitable deduction if established via their will/estate) once the assets are pledged to the trust. As such, a CRUT makes the most sense in a tax year in which a large income event has already occurred (or will occur) since it may be ideal to pair the potentially large charitable deduction with a year of high income - to get the most out of the deduction. Once the assets have been contributed to the CRT, the trust itself becomes an effective income tax management vehicle as well, as the trust itself in this instance is a tax-exempt entity under IRC 664 (more on this below).

CRUT Deductions

To receive the aforementioned tax deductions upon the contribution of assets into a CRT, the following conditions must be met:

A fixed percentage of at least 5%, but not more than 50% of the fair market value of the trust must be paid to the non-charitable beneficiary each year.

The charity must have an actuarial interest of at least 10% of the initial trust value. This is to ensure that the trust is calculated to likely receive more than an inconsequential amount at the end of the trust term.

The value of the trust must be revalued each year (to determine the appropriate distribution). For example, if the unitrust interest is set to be 5% of trust assets, this 5% will likely fluctuate as the net fair market value of the trust changes year over year.

The term of the trust must be 20 years or less, or until the income beneficiary dies.

The trust may never pay more than the fixed percentage established at the trust’s inception.

At the end of the trust, the entire remaining balance of the trust’s assets must be distributed to the designated qualifying charity. Thus why the 10% remainder interest rule is in place.

If these criteria are met, the donor receives an immediate income tax deduction for the present value of the remainder interest projected to pass to the charity at the end of the term. With the rise of Donor Advised Funds (DAFs) as a charitable giving vehicle, it may even be possible for a DAF to be the remainder charitable beneficiary which can then be used to disburse funds to a variety of different charities at that time. This is beneficial if a donor is unsure of which particular charity they may want to benefit many years from now, yet still wants to set up this strategy at present times.

CRUT Tax Management & Deferral

As stated above - a CRUT is exempt from federal income tax per section 664 of the Internal Revenue Code. The income and gains of the trust are only taxed when they are actually distributed to the noncharitable beneficiaries receiving the income interest each year. Therefore, a CRUT is frequently used to defer income tax on gains about to be realized.

If a donor has an appreciated asset that is about to be sold, the donor may look to transfer the asset to a CRUT. Once in the CRUT, the donor can still reserve the right to received a fixed percentage of the value of the trust for life as we’ve established above. If the appreciated asset is sold by the trust after being transferred, the proceeds of the sale can be reinvested into a more diversified portfolio without having to pay any federal income tax on the capital gains. The capital gains from the sale will be taxable to the donor as they are distributed to the donor as part of the annual distributions from the trust.

It is important to understand however that Income distributions from a CRUT itself are subject to a distribution hierarchy in which the least favorable character of income is distributed first (ordinary income), followed by capital gains, and finally tax-free income being the last income distributed to an income beneficiary. Therefore, if an asset worth $2,000,000 is sold within a CRUT - completely at a 100% long-term capital gain - and the proceeds are reinvested into a portfolio creating 5% investment interest (ordinary income in nature), and the trust is to pay out 5% to the donor each year - the donor would be taxed at ordinary income rates on the entire 5% distribution, rather than receiving the lower taxed, capital gain income. This is because the higher, ordinary interest income is required to be distributed first. This would be less than an ideal outcome for most, however it does still manage the income tax implications as the tax is able to be spread over many years rather than realized all at once if the assets weren’t in a CRT.

Tax Arbitrage Opportunity

In addition to the income tax timing opportunities discussed in the prior paragraph, a unique point to consider regarding CRTs is the tax arbitrage opportunity of the charitable deduction. Benefiting a charity with the remainder interest is a key requirement for anyone that wants to engage in this strategy. However, the income tax deduction that a donor receives is determined in the year in which the assets are irrevocably contributed to the CRT. This deduction is determined based on actuarial assumptions and the prevailing Internal Revenue Code Section 7520 rate - which changes each month. If for example, based on the current 7520 rate, the unitrust interest percentage and other factors, that the remainder charitable interest is determined to be 20% of the initial trust assets, that is the portion eligible for a charitable deduction in the year the trust is established and funded. If, however, the trust lasts for 20 years and at the end of 20 years, the remainder interest is less than the previously anticipated 20% (Adjusted for inflation, discounted, etc.) , then the donor was able to obtain a larger charitable deduction while also retaining a larger income benefit than what was truly calculated as a benefit to the charity. Now, ideally this should never be the goal of establishing a CRT, but if tax-management and planning were the top priority and the charity were to receive slightly less than the deduction received, many taxpayers may view this as effective tax planning.

A Different Flavor CRUT

A variation of the CRUT is the net-income-makeup CRUT, also known as a "NIMCRUT.” This trust adds more flexibility than a standard CRUT. It pays the lesser of either:

the fixed percentage established when the CRUT is created, or

the income actually received by the trust.

However, if the income is less than the fixed percentage, the deficiency can be paid in a future year, as soon as the trust has income, which exceeds the fixed percentage. This adds another level of flexibility in the cash flows that have to be taken from the trust - and as a result the associated tax accompanying any distribution. A NIMCRUT is valued in the same way as a regular CRUT for the purpose of determining any associated tax deductions.

An Example

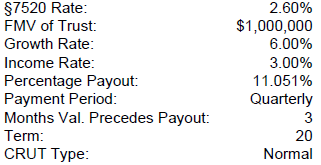

The below is an example of a 20 year CRUT, worth $1,000,000 initially that grows at a combined 9% rate of return and has a unitrust interest of roughly 11%. The resulting income tax deduction is about $100,000 or about 10% of the initial trust value.

If the trust assets performed as projected above, the end result after 20 years would be an approximate total of $1,782,000 received as income distributions and $623,300 passing to a charity.

Last Words

CRTs are a complex and unique piece of our federal tax code. Before engaging in a CRT strategy be sure to work with an experienced tax and investment advisor that understands these rules and how to navigate them efficiently. There are many other considerations and rules that are not addressed in this article that need to be taken into consideration when determining if a CRT makes sense for you and your financial plan. Having said that, for appropriate situations, a CRT can be a very powerful long-term planning tool to help diversify highly appreciated assets, while managing tax liability, retaining wealth and benefiting a charity. If you have questions on CRTs, charitable tax and wealth planning strategies, or other wealth transfer techniques please contact us. We’re here to help.

Disclosure: Hudson Oak Wealth Advisory LLC (“Hudson Oak” or “Hudson Oak Wealth”) is a registered investment adviser in the State of New Jersey & New York. For information pertaining to Hudson Oak’s registration status, its fees and services and/or a copy of our Form ADV disclosure statement, please contact Hudson Oak. A full description of the firm’s business operations and service offerings is contained in Part 2A of Form ADV. Please read this Part 2A carefully before you invest. This article contains content that is not suitable for everyone and is limited to the dissemination of general information pertaining to Hudson Oak’s Wealth Advisory & Management, Financial Planning and Investment services. Past performance is no guarantee of future results, and there is no guarantee that the views and opinions expressed in this presentation will come to pass. Investments involve risks and may lose value. Figures displayed within this communication are for illustrative purposes only. Nothing contained herein should be interpreted as legal, tax or accounting advice nor should it be construed as personalized Wealth Advisory & Management, Financial Planning, Tax, Investing, or other advice. For legal, tax and accounting-related matters, we recommend that you seek the advice of a qualified attorney or accountant. This article is not a substitute for personalized planning from Hudson Oak. The content is current only as of the date on which this article was written. The statements and opinions expressed are subject to change without notice based on changes in the law and other conditions.